[UPDATE: This post is now endorsed by Vint Cerf. I can die happy.]

[NOTE: If you are more technical-minded, you may prefer my recent presentation to a group of local I.T. professionals, Net Neutrality: A Sorta-Technical Overview.]

[UPDATE: In 2021, this post drew the attention of Republican FCC Commissioner Nathan Simington, and we had a lovely chat about it.]

Like most Americans, conservatives do not know very much about Net Neutrality.

(Image credit: DaddyChief.com)

What they do know about it makes it sound like a terrible idea: a bunch of Silicon Valley elites, backed by the Google panopticon and the Mozilla jerks who publicly executed Brendan Eich over his quiet support for traditional marriage, are demanding that the FCC impose sweeping regulations on the companies who bring the Internet to your door. With help from their close ally President Obama, these shysters have made tremendous forward progress against the so-called “evil” corporations who (in reality) own, develop, and generally manage the series of tubes that make up the Internet – corporations who have, in short, ushered in the entire Internet Age and all the good it entails. The only people in this drama who are holding off the regulators are the valiant heroes at the Wall Street Journal and the National Review, who are not afraid to stand athwart the regulatory agenda yelling “stop!,” demanding free markets and free peoples and not an iota less.

Given that narrative, it seems odd for a conservative – whether an old-guard big-business Bush-era conservative or a new-guard Paulite libertarian conservative – to support Net Neutrality.

Except I do Internet for a living, and I am one of the lucky ones who actually knows what Net Neutrality means and what it’s responding to. And, folks, I’m afraid that, while L. Gordon Crovitz and Rich Lowry are great pundits with a clear understanding of how Washington and the economy work, they don’t seem to understand how the Internet works, which has led them to some wrong conclusions.

A Functioning Free Market

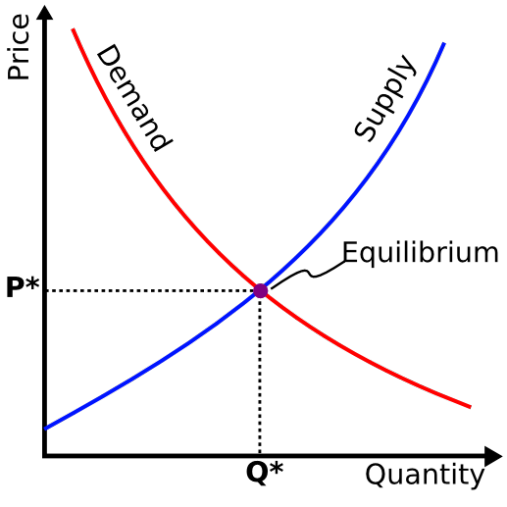

Let’s start at the very beginning: how does a free market work? Presumably, as a respectable conservative, you’re familiar with the bare-bones basics, but I’ll still run through them quickly here. (If you have seven minutes to spare, this entertaining video does a nice job explaining competitive markets in greater detail.) Here’s a standard supply-demand graph:

In a free and competitive market, consumers want a product. Let’s say our consumers are tourists in Chicago, and the product they want is a Chicago dog from an outdoor hot dog cart.

Now, if a hot dog cart man is selling a Chicago dog for $1000 apiece, not very many tourists are going to want to buy a hot dog; they’ll go to another cart. If every cart is selling Chicago dogs for $1000 apiece, most consumers will just go to Gene & Jude’s for an indoor dog, or skip lunch entirely. There will be a surplus of outdoor hot dogs. That’s what happens on the right side of the graph: the high price makes the market very attractive to suppliers, but very few consumers remain in the market to pay that price. Everybody loses: the vast majority of consumers don’t get the hot dogs they want, and the vast majority of cart owners don’t sell any hot dogs. There’s a huge gap between supply and demand.

On the other hand, if one hot dog cart is selling dogs for a penny each ($0.01), he’s going to find that lots and lots and lots of consumers want to buy his hot dogs. But he’s going to find it very difficult to stay in business with hot dogs at such a low price. If consumers get it in their heads that nobody should pay more than a penny for a genuine street-cart Chicago dog, nearly all hot dog cart owners are going to leave the business – they simply can’t make a living without selling hundreds of times as many hot dogs every day, and they can’t afford to invest in the infrastructure (extra grills, bigger carts, hired help) that they would need in order to run an operation of that scale… especially not at that price! In the end, everybody still loses: consumers end up mobbing the handful of sellers who stay in business, and those few sellers can’t possibly make enough hot dogs in a day to satisfy all those hungry tourists. When the price falls too low, consumers get hurt because supply shrinks, causing a hot dog shortage. That’s what happens on the far left side of the graph: the low price makes demand very high, but leads suppliers to produce and sell very few Chicago dogs. There’s a huge gap between supply and demand.

The beauty of the free market is that competition self-corrects these gaps between supply and demand when they arise, guiding them toward equilibrium, which is the point at which everybody wins – consumers get the most hot dogs, and vendors get the most business. Let’s say the going price for streetcart Chicago dogs (the current market equilibrium) is about three-fifty ($3.50). One vendor decides one day that he doesn’t make enough money, so he’s going to sell his dogs for $7.50 instead. Easy market response: everyone stops buying from him, and he goes out of business. Equilibrium is restored. No one supplier can arbitrarily shift the market against consumers.

However, the contrary could happen. Suppose a vendor realizes that, using a new fuel-efficient grill, he can make Chicago dogs at a lower cost than everybody else. So he buys a grill and cuts his prices, selling the same quality hot dogs for $2.50 while keeping the same profit per hot dog. Consumers flock to this vendor, driving up his profits while dramatically driving down demand for more expensive hot dogs. So his competitors – who want to stay in business – buy the same fuel-efficient grills… and, if they don’t, entrepreneurs will realize there’s money to be made supplying the demand for $2.50 hot dogs, and open up their own hot dog stands with their own fuel-efficient grills. Either way, when the dust settles, the new “going price” for streetcart Chicago dogs ends up at $2.50.

In other words, the entire supply curve has “shifted” to the right, driving down the equilibrium price for the entire market, all because one man came up with a single innovation. Meanwhile, that one man, because he discovered this efficiency, sells lots and lots of hot dogs to eager consumers while the market adapts to his innovation, and is fairly rewarded with a ton of money. This beautiful mechanism, called the “invisible hand,” drives the entire American economy: individual entrepreneurs and big corporations all want to make innovations and drive down prices, so that they can make a ton of money while the market adjusts. Consumers win as prices are eternally driven down toward the minimum possible cost (with the minimum sustainable profit).*

Unfortunately, one regulation can crush the entire market. In our example, we have a thriving competitive hot dog market. In reality, however, the tightly-regulated City of Chicago has made it illegal for street vendors to sell any hot dogs. It doesn’t matter how much consumer demand there is, and it doesn’t matter how many people want to go into business to fulfill that demand: nobody gets any outdoor hot dogs (unless they’re willing and able to successfully break the law, as a few do, at high cost), so we end up with an extreme hot dog market shortage, imposed by the government. In the end, everybody loses – except the bureaucrats.

Government is doing this, to greater or lesser extent, all the darn time. Every time the government imposes a sales tax, or a licensing fee, or a reporting requirement, or virtually any regulation at all, it means that there are additional costs built into the supply curve that aren’t naturally there. This shifts the curve to the left, raising prices for the entire market, and putting products out of reach for some consumers (especially the poorest: all free-market regulations are, in effect, regressive taxes). In some cases, the government may even impose price controls, which sets market price at something other than equilibrium, directly and deliberately creating a surplus or shortage that creates losers among both consumers and producers… with no winners (besides the bureaucrats).

As a result, conservatives are highly skeptical of regulations of all kinds and want to demolish much of the Washington bureaucracy. We may agree that some regulations are necessary – most of us are willing to accept the added costs that come because the FDA checks that drugs sold to Americans are safe, and most of us agree that someone (the SEC) needs to be able to prevent dishonest behavior on the stock market – but we recognize that those choices do carry big costs, and we are deeply troubled by the size and scope of the modern regulatory state (including the FDA and SEC). The invisible hand is a hundred times better at promoting the general welfare than crony capitalists and liberal special interest groups.

However, as conservatives have recognized for over a century, there are situations where the market simply breaks down. The invisble hand stops moving, and the only thing that can save the freedom and competition of the market is government intervention. We don’t like it, and, thanks to modern laws, it happens pretty rarely, but, when it arises, the dedicated free-marketeer grimaces, pulls out the sword of bureaucracy, and attacks without hesitation. The very worst-case scenario is called “monopoly.”

Monopoly: When The Music Stops

I couldn’t find a video for this that explained quite what I wanted to explain, so here’s a song instead. (This video is also pretty good, but contains spoilers for the rest of this article.) Happily, it’s not very hard to explain what a monopoly is and how it attacks freedom in the market.

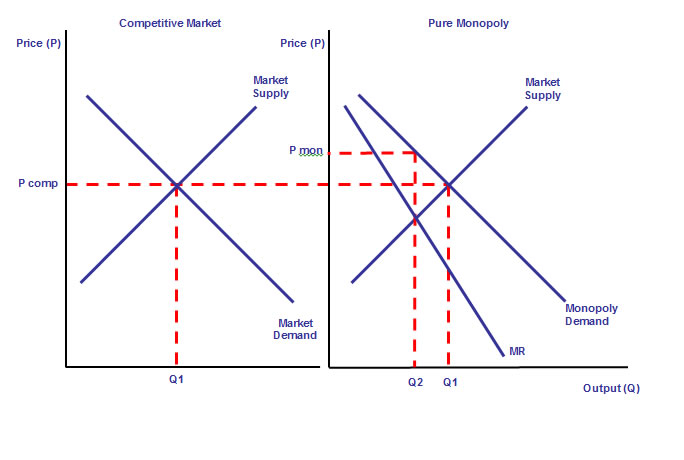

Monopoly is when a single seller controls the market. There is no competition. Indeed, because the monopolist is able to set prices wherever he wants, a monopoly is able to destroy any competitors who attempt to enter the market (by undercutting their prices, even at a loss, until the competitors die). There is also little innovation, because there is little incentive for it, and, when innovations are developed, the savings are pocketed by the monopolist, not the consumer. Finally – worst of all – the monopolist is able to set prices, not at the optimal equilibrium point where a free market would put it, but at a different point – which turns out to be a point off to the left of equilibrium, where price is higher and quantities are lower than consumer demand in a free market would sustain. Consumers are trapped. Competitors are destroyed. The invisible hand stops. The free market becomes a tyranny, where the only freedom that counts is the monopolist’s.

To illustrate, let’s return to our Chicago dog streetcart market, where the equilibrium price has settled at $2.50. Now suppose George Soros rolls into town one day and decides he wants a piece of the action. So he buys every single hot dog streetcart in the city. Now that George controls the market, he has no competition. Remember earlier when we saw a single streetcart vendor raise his price to $7.50, because he wanted to bring home more money? He was driven out of business, because consumers had no reason to put up with that and went to his competitors. But George has no competitors. If he raises his prices to $7.50, there’s not a thing consumers can do about it. They have to buy from him, or go without hot dogs. Of course, “go without” is exactly what many of them will do. But some will still be willing to pay that price, even though the price is way outside what a free market would tolerate. George may also decide that he doesn’t need a cart on every street corner anymore, so he closes three-quarters of the stands, creating artificial scarcity. The invisible hand is no longer forcing him to serve the consumer in order to serve himself; a disconnect has opened up. Ultimately, the price and quantity he sets will be determined by marginal cost/revenue curves, the details of which go beyond the scope of this post, but which will both be quite different from the market equilibrium – and detrimental to everyone else in the market. Soros will gouge customers every way he possibly can, to the very limits of their tolerance and willingness to get hot dogs. Welcome to a new world of ketchup fees and lower-quality meats being sold at the same price. Some consumers will still get their hot dogs, but at a much higher cost with far fewer options and much lower quality.

And say one of George’s hot dog stand operators discovers an even more fuel-efficient way to grill hot dogs, so the equilibrium price of hot dogs falls even further, to $2.12. You think the Soros Chicago Dog Empire is going to cut prices accordingly? No: it will implement the grills, if it saves them money, but those savings are going straight into George’s money bin, not getting passed on to the consumer.**

But what if an angry citizen decides to open his own hot dog stand to resist the Soros monopoly, selling dogs once again at the market-clearing price of $2.50? Easy: Soros has big reserves of stockpiled money from his monopoly profits. He cuts the prices at his stands to $1.50 and sells hot dogs at a loss for a few weeks until – inevitably – the competition fails and closes. (He may also use his monopoly power in other nefarious ways. For example, he might buy some city councilmen to pass a law requiring all streetcart vendors to purchase a $1 million license, or he might just hit them with frivilous lawsuits until they die.) Once the competitor is gone, George raises prices again to $7.50.

It is worth noting that most of the above holds true even if there is a single competitor in the market (called a “duopoly”), and quite a bit still holds true when there are just a handful of competitors (“oligopoly”). It is simply too easy for a small number of sellers to tacitly avoid price competition or innovation in order to maximize individual profits, becoming a functional monopoly that prevents the free-market outcome. In order to have true competition and a vigorous free market, many sellers must be in competition with each other – so many that it becomes impossible to formally or informally fix prices or form cartels. But the worst and clearest case of this market distortion is certainly the classic single-seller monopoly.

The tyranny of a monopoly market is why conservatives have always opposed monopolies. It’s also why we (unlike liberals) oppose government monopolies. Want a great example of how monopoly drives down supply, eliminates consumer choice, and hinders innovation? Look no further than single-payer health care, with its long waiting lines, denial of expensive treatments to patients, and general stagnation.

Unfortunately, when a monopoly arises in the private sector (which is very rare today) (UPDATE: not actually that rare), the only entity that can fix the market is the government. Sometimes, the government can limit itself to a stern warning: “If we see you backing off on innovation or raising prices above equilibrium or cheating to crush competitors, we will break up your company!” (That’s more or less what happened to Microsoft, in the end – the government’s threats kept Microsoft in line and market forces functioning until their monopoly, which was always a very weak one, was naturally eroded by said market forces.) Sometimes, the government has to go in and simply break up the company into many smaller companies, as President Reagan did to Ma Bell in 1984. But, whatever the particular tool employed, every true believer in the free market system knows that one of the few things government is good for is protecting free markets them from the tyranny of monopoly.

What’s this have to do with the Internet?

Natural Monopolies: Everything Is Upside Down

In a normal market, the more product you sell, the more it costs. If you want to sell ten hot dogs in an hour, you have to buy enough meat, bread, and condiments to make just ten hot dogs. If you want to sell a million hot dogs in an hour, then you have to buy a lot more meat, bread, and condiments… and you have to hire people to help prepare the dogs, you need inventory tracking, you may find that you’re driving up the price of hot dog meat in the area just because you are demanding so much. The more you sell, the more it costs. This is almost always true, so much so that the supply-demand graph simply assumes it.

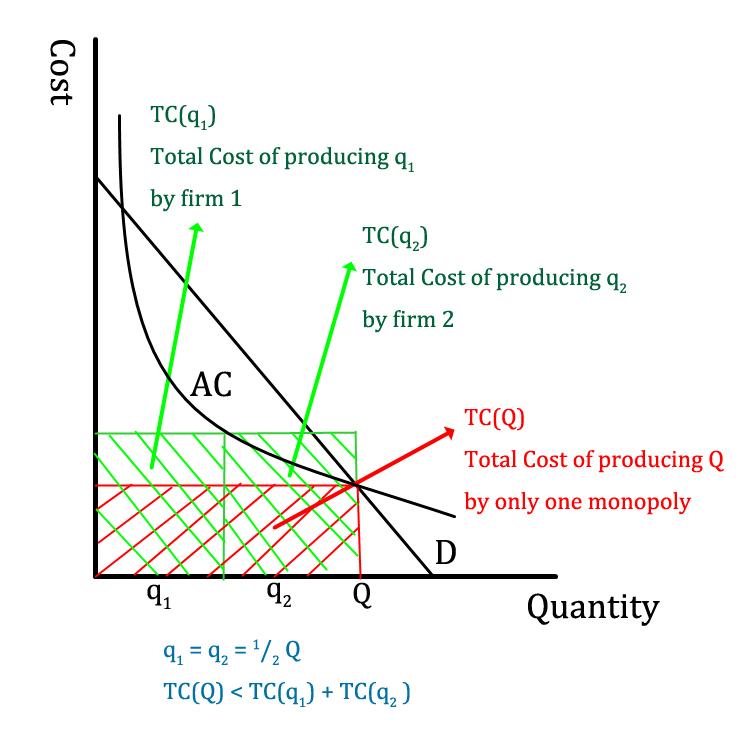

However, there are some markets where it is not true. Consider a power company at the dawn of the Electric Age. They build a power plant and power lines to carry electricity throughout town to their wealthy customers. One day, Bob the Barrister decides he wants electricity, too, so he calls the power company, which drives out, connects Bob’s house to the grid, and begins charging Bob for the electricity. Here’s the magic: by selling more product, the power company’s costs actually go down. See, it was already producing the electricity that Bob just purchased, because that’s mostly how generators work – they produce a certain amount of electricity, whether it gets used or not. It’s just that, until Bob signed up, that electricity was going to waste. Now Bob is paying for it. The power company also already had most of the infrastructure to move Bob’s electricity the five miles from the power plant to Bob’s house. Now Bob is helping pay for that infrastructure, too. The only added cost from Bob signing up with the power company was a single short cable and an hour or so of labor – which, from the company’s perspective, is a very low cost indeed, and is more than offset by the savings Bob’s membership brings. In fact, the more product the power company sells, the lower their average cost goes. In theory, they’d be able to return those savings to the consumer, lowering the price of electricity for all their customers.

This makes it almost impossible – indeed, economically inefficient – for competition to survive in a market like this. All companies in the market fight bitterly to get the most customers (this is good). But, as soon as one company gets a small lead over the others, that company is able to cut prices, leading more customers to sign up, allowing the company to cut prices more, leading more customers to sign up… while the other companies are losing customers and are forced to raise prices, causing them to lose more customers, until they eventually go out of business. It’s a domino effect, where the invisible hand herds consumers into signing up with the same company faster and faster until it’s the only company left standing. Potential new competitors face daunting startup costs and the impossibility of beating the market leader on price. As a result, the single company that survived becomes a monopoly… and, as soon as its last competitor is dead, it begins raising prices to take advantage of monopoly profits. Because market forces alone forced this to happen, it’s called a natural monopoly.

Many utility markets are natural monopolies in one way or another. Electric power is a classic example, water another. Governments regulate these markets in various ways. Most U.S. water systems are regulated very simply: they are owned and operated directly by the government, with no private competition allowed (not that it would be feasible anyway). The government then aims to deliver clean water to customers at the lowest possible price (with varying success). Most people buy their electricity from a company, but, in most states, that company is regulated closely by the government, which sets a legally mandated price that all electric companies must use; this prevents local electric monopolies from abusing their monopoly position as described in the previous section. In some states (like Texas), electric companies are allowed to set their own prices, and this is called “deregulation”… but it’s not really deregulation, because of one critical factor: every electric company is given free access to the power lines of incumbent monopolies by law, and those incumbent monopolies remain regulated and protected in various ways. Generation is deregulated, but the delivery network remains under government’s tight control.

None of this is ideal. Government-run or government-regulated monopolies don’t rely on the market to set prices; they rely on the best guesses of well-intentioned but dim-witted bureaucrats. They are complacent and often fail to innovate, because they have little or no incentive to do so. Their service is usually not as good as you’d expect for the price you’re paying, although you retain some leverage simply because you can vote out city officials who don’t do their jobs. Republicans and other free-marketeers generally work to deregulate as much as possible in these situations (see their handiwork in Texas) trying to get some invisible hand action back into the market… without allowing unregulated natural monopolies to take over the whole thing.

Because – as Republican free marketeers know – an unregulated natural monopoly is far worse than even a government takeover. Rather than relying on well-intentioned bureaucrats to set a fair price, the monopolist sets prices as high as possible – far higher than a free market would allow. Monopolists, too, are complacent, and don’t just fail to innovate, but often fight innovations, because innovation could disrupt their control. Their service is abysmal, because they have absolutely no reason to care about you or your money. After all, what are you going to do? Disconnect from the electric grid? Move to another state? In economic terms, your personal demand curve is inelastic. In practical terms, they don’t care whether you’re satisfied with their service, and they don’t care whether they provide you with fair service at a fair price. You need their service and will pay nearly any price, tolerate nearly any indignity, to get it. While much of the monopolist’s effort remains focused on adding customers early on, that gradually peters out as they approach saturation, and instead they begin to work on ways to gouge more money out of existing customers.

Perhaps you begin to see the connection to Internet Service Providers.

How the ISPs became Natural Monopolies

When my household first logged on to the Internet in 1996 (mwong-NWANG-mwong DING DING), we were subscribed to a small ISP named SpryNet – a company so unimportant it doesn’t have a Wikipedia article, one of more than 1,400 options available to the just 20 million people who were online at the time. But, in 1998, a new trend began: SpryNet was bought out by MindSpring, a bigger ISP. In 2000, MindSpring got bought out by EarthLink. A couple years later, EarthLink’s high-speed internet service in our area (the Twin Cities) was taken over by Comcast (they kept the EarthLink branding for a while, but eventually we became Comcast customers). And that was the end of that. The huge range of ISP options we had in the early days of the Internet had shrunk to just two: Qwest (now CenturyLink) and Comcast. And if you happened to want high-speed Internet that’s sufficient for HD video streaming or gaming, you actually have just one choice: Comcast.

The Twin Cities ISPs have consolidated. And we’re actually one of the lucky cities: we technically have two ISP options, which puts us in the same boat as 37% of Americans. 28% of Americans have only one option for broadband internet. (2%, mostly in rural areas, have zero options.) That means, for all the freedom and competition happening on the internet, fully two-thirds of Americans live in areas where access to the internet is determined by either a near-monopoly or a literal monopoly (see figure 5(a) here; for counter-point, see figure 5(b)). Once Comcast and Time Warner Cable complete their merger, that number will skyrocket – and, what’s worse, economics tells us that, unlike most markets, ISPs will naturally continue to consolidate until every consumer has one (and only one) broadband internet option.

That’s because – guess what! – internet service is a market where natural monopolies prevail. Just like with the electric company, most of the cables and most of the network are already purchased and deployed. Adding a new customer often means literally just flipping a switch at HQ, or – at most – laying a few yards of cable to an existing network. In the end, the more the company sells, the less it costs them. Over time, the big companies beat the small ones on cost, gobble them up… then lobby the government to freeze out potential competitors, while jacking up costs and slashing service quality,.

If you have ever interacted with Comcast in any way, you already know about their “service” “quality” – the infinite wait times, the incompetent “help,” the constant upselling, the blatant lies (usually about credits they promise), the desperate measures. Since they are our local monopoly, I don’t hear too much about the other monopolists out there, but I understand Time-Warner isn’t any better. It is a fact that customers despise their ISPs on average:

What you may not realize is that they are overcharging you, too, like textbook monopolists.

For one, their prices are way higher than they would be in a competitive free market. They just are. It does not cost $90/month to provide 250GB of 20 mbps service to a residential consumer in a dense metropolitan area. It doesn’t cost anywhere close to that.

But the really worrisome thing is that they’ve now started shaking down other companies. Verizon is deliberately slowing down Netflix traffic until and unless Netflix agrees to pay Verizon protection money. (Verizon brands this as paying for the use of Verizon’s network… but Verizon’s customers who access Netflix are already paying for every bit and megabyte Netflix sends over Verizon’s network. Downstream network access is what we’re charged for every month.) Several other ISPs (including Comcast) have already gone through similar bouts with emerging internet titans like Netflix – and won their share of money. Guess who’s paying for that? You are, my friend, only now it’s through your Netflix (or Hulu or Amazon Prime) bill instead of your ISP bill. Clever, right? The ISP manages to raise the price of your internet use, but hides it from you by shoving it onto a third party.

This practice is not only new; until this year, it was also considered illegal. One of the basic design principles of the World Wide Web (according to its inventor, Sir Tim Berners-Lee) is the idea that network owners may charge individuals to access their networks, and may charge them for data use, but, once individuals are on the network, the network must treat all data equally. Comcast cannot decide to delay your download of a YouTube video in order to make more room on the network for your neighbor to download the same video from Comcast.com; you both paid equally for network access for the same amount of data, so the network must treat your data equally. Without this principle, much of the internet breaks down. It stops being an open network facilitated by service providers – who merely connect you to whatever data you want, anywhere on the network – but becomes a closed network shaped and ultimately controlled by service providers – who drive you toward a limited number of ISP-owned services and content streams that wouldn’t surive in the online free market free-for-all we have today. That principle – a core design at the very heart of the World Wide Web and all the brilliant competition and innovation that has come from it – is called Network Neutrality.

And the ISPs want it dead, because, if they kill it, they can rake in monopoly profits without consumers realizing what’s happened.

A couple years ago, AT&T blocked Apple’s video chat app (FaceTime) for all customers who weren’t paying for unlimited voice and text messages – even if they were already paying for unlimited data (FaceTime used data, but not voice or text). AT&T simply straight-up refused to allow a competitor to beat them on price.

In 2007, Comcast “throttled” (blocked) BitTorrent files that were moving over its network. Although many people use BitTorrent files for illegal activity (like everything else on the Internet), a great many small tech-savvy distributors rely on BitTorrent to transfer their hosting and bandwidth costs to consumers – which Comcast didn’t like one bit, since it meant consumers actually ended up using the data capacity they were paying for.

We could go on, through data caps and artificial shortages, but I think you get the idea. The ISPs have become, or on the threshold of becoming, natural monopolists, and they are beginning to flex their muscles. There’s only one entity that can protect consumers and the market, imperfect though it is: the government.

Ma Bell or Microsoft? Government Responses to ISP Monopoly

Conservatives (rightly) want to keep markets as free of government influence as possible. When the government must intervene, conservatives (rightly) give the government only as much power as it absolutely needs in order to protect the health of the free market. So what’s the minimal possible response to the ISP problem?

Ideally, we’d pull what we pulled on Microsoft: threaten them a whole lot, force them to back down repeatedly, and just wait them out until something unimaginable comes along and disrupts the whole market, ending the threat of monopoly. This strategy is messy and prolonged, but it preserves the market without the government ever actually doing anything. I have supported this tactic since 2006, when Net Neutrality first became an issue. Liberals, of course, wanted to regulate everything immediately, the moment they even thought of the possibility of an ISP abusing its power someday. But that was stupid, I thought. The FCC had rules protecting Net Neutrality. They were a little amorphous, a little legally grey, but they helped the FCC stop abuses (like the FaceTime and BitTorrent incidents mentioned above), and ISPs (in 2006) were willing to abide by them. Their willingness was all we needed to forestall the most serious, immediate threat from the encroaching monopolies – the threat to net neutrality. We held off on tighter regulation and waited to see what would happen.

What happened, unfortunately, is one of the ISPs – Comcast, in this case – decided to stop abiding by the FCC’s (legally questionable) net neutrality rules. Comcast sued the FCC. In 2010, Comcast won, forcing the FCC to draft new (and equally questionable) rules to protect net neutrality. This time, Verizon sued… and, early 2014, they won. The FCC’s rules on net neutrality were utterly vacated, and the courts concluded that the FCC had no power to impose any effective net neutrality rules without invoking Title II of the Communications Act (we’ll come back to that).

So now the delay-and-harass strategy has failed. The monopolists have a blank check from the law, and they are exploiting it with tremendous rapacity (as we’ve seen in the series of Netflix stickups, which picked up the moment net neutrality collapsed). Perhaps the next most attractive option is to pull a Reagan and just break up the major ISPs into smaller companies. Unfortunately, there is no obvious legal way to do that. The Bell breakup resulted from a lot of special circumstances, some plain-as-day antitrust violations, and an 8-year court battle. Moreover, breakup would probably not solve the problem: the wee ISPs would still have local monopolies in many areas, and economics 101 would force them to immediately begin reconsolidating into new national monopolies (as the Baby Bells are doing today). In the long run, the consolidation and price gouging of natural monopolies are probably inevitable. It’s a cold, heartless law of economics: the same laws that allow the government to increase revenues by cutting taxes will eventually compel certain telecom markets to become monopolies, no matter how many times we break them up.

Another option would be to promote or require more competition, subsidized or operated by the government if necessary. This strategy is repugnant to conservatives, and for good reason: a private monopoly versus an unaccountable public bureaucracy bailed out by taxpayers is not exactly the “functioning free market” we envisioned 16 pages ago. (Yes, you’re 18 pages into this post.) However, it’s a moot point: thanks to brazen rent-seeking by major ISPs, local governments are barred by law from providing municipal internet as a public utility in nearly half the states. The FCC can’t touch that, and – for better or for worse – Congress won’t.

So this leaves only one apparent option to hold the monopolists in check: Title II regulation under the Communications Act of 1934. You’ve probably never heard of it. In fact, your eyes probably glazed over as soon as you saw the words “Title II,” because that sounds super-legal and super-boring. It is both those things. I’ll spare you the full 102-page law and give you the highlights.

Way way back in the 1930s, Congress noticed that phone companies were becoming natural monopolies, and created the FCC to deal with them. Congress gave the FCC broad authority to regulate phone companies the same as other “common carriers.”

Common carriers are companies that sell bandwidth (such as a passenger seat on an airplane, or a cubic foot of space on a freight train) to the public at large. Because of their unique, key position in the national transportation infrastructure, they are also required to actually serve the public at large. If you have the money to pay for a ticket on an American Airlines flight, there’s a seat available, and there’s no other justification for denying you a ticket, then American Airlines must sell you that ticket. Everyone must be given equal access to the nation’s transportation networks – as long as they can pay the price. When Congress extended the “common carrier” concept to include not just physical goods and persons (transmitted by rail and sea), but also data (transmitted by phone and telegraph), it entrusted the FCC with licensing and regulating this new class of common carriers. The FCC’s mandate was to prevent the common carriers of data from arbitrarily denying service to lawful users, or from freezing into a monopoly or cartel. It could even require phone companies to make interconnections between different phone networks, in order to ensure that everyone with a phone could reach everyone else with a phone.

In 1989, Al Gore invented the Internet (working under the name Tim Berners-Lee), and, immediately, Internet Service Providers became common carriers under the law. Of course they did. ISPs literally sold bandwidth to the public, and the new World Wide Web depended on the public being given equal access as long as they were willing to pay. Naturally, the FCC would regulate ISPs the same way it had regulated the phone companies for 60 years. And, throughout the dial-up era, it did. In 1996, Congress passed the Telecommunications Act of 1996, which updated the FCC for the Internet Age. The “Republican Revolution” Congress under Speaker Gingrich made sure that the updated framework did as much as possible to promote competition in the market – without allowing monopolies to overtake that competition. A few years later, DSL came out (for you youngsters: DSL was an early form of broadband internet). The FCC examined DSL and ruled that it fell under the common carrier provisions. It obviously met the definition, so how could it not?

A little after that, cable broadband internet began rolling out to consumers. The FCC examined it… and a remarkable thing happened. In 2002, the FCC ruled that cable broadband was neither a “telecommunications service” nor a “cable service” subject to common carrier regulation. Instead, cable broadband was solely an “information service,” with no telecommunications or cable element included. Since information services can not be regulated as common carriers under Title II, this freed cable broadband providers from all those regulations. Of course, this was a ludicrous ruling. The Telecommunications Act of 1996 leaves no wiggle room for cable modem operators: they are clearly telecommunications services. The “information service” classification, by the FCC’s own precedents, was for services like Google, or your library catalog system, not an ISP; indeed, information services were unregulated precisely because they involved little to no infrastructure and few, if any, barriers to entry. So, you know, the exact opposite of ISPs.

The FCC spent thirty pages producing a convoluted rationale, often mistaken in technical details, for this absurd ruling, but admitted in the press release what everyone else already knew: the FCC was trying an experiment in total telecom deregulation, hoping that, by continuing the process of deregulation, competition (which had not materialized in the wake of the 1996 Act) would finally emerge in the ISP market and stop the slide toward monopoly. They didn’t really care much about the legal details; they just needed to find a justification that could survive judicial scrutiny – which is not a high bar to clear, given the immense deference courts must give to the FCC and other regulatory agencies. The FCC’s goal was deregulation by any means necessary.*** Sure enough, it survived review under Chevron deference in a 6-3 Supreme Court ruling (Justice Scalia’s blistering dissent is, as always, a fun read). A few years later, the FCC extended the same deregulation offer to DSL and phone services. They eagerly took it. Suddenly, ISPs in America were no longer considered “common carriers” under law (even though they obviously were common carriers in actual fact). Regulation got out of the way… which let the natural monopolists go to work destroying what free market there was.

We Must Destroy the Market To Save It: Towards Title II

To sum up, the only reason the Internet isn’t protected from monopolies today is because, in 2002, the FCC decided to experiment with not regulating the Internet. Almost immediately thereafter, the telecoms began fighting the core Internet principle of network neutrality, aiming to take control of the Internet for themselves and impose monopoly prices on consumers. All attempts to restrain them outside of Title II have failed. The Wall Street Journal regularly argues that the Internet has thrived because ISPs have never been regulated like phone companies. This is false, and the Journal should know better. Indeed, the years of the Web’s most explosive growth and development happened under the auspices of strict common carrier regulation, identical to those of phone companies. (Heck, even today, limited portions of Verizon’s high-speed fiber network, FiOS, fall under Title II!)

The fix to the growing monopoly problem is very, very easy, and several courts have pointed to it over the past several years: simply revisit the obviously nonsensical ruling of 2002. Overturn it, and (correctly) decide this time that Internet Service Providers are “telecommunications providers”. Instantly, every ISP in America would go back to common carrier status, and net neutrality regulation wouldn’t just become easy; in many ways, neutrality is baked into Title II. The FCC would gain many tools to reduce the risk of natural monopoly where it doesn’t exist, or its effects where it does. The market would be saved, the consumer freed from the tyranny of monopoly.

This isn’t an “everybody wins” situation, of course. As conservatives, we know that regulation is always evil, even in the rare cases (like this one) where it’s a necessary evil. The regulatory regime raises the costs of doing business, encourages corporate rent-seeking and bureaucratic co-opting, empowers yet another Washington agency, and makes it more difficult for genuine innovations to get into the market. Market distortions based on political considerations are possible, even likely (see here). Heavy regulation forestalls new entrants in a market (not that this seems to be a problem in the ISP market, where natural monopoly prevents new companies from joining anyway). Reclassification will (probably) have unanticipated consequences, which, by definition, I can’t describe or evaluate here. The unexpected consequences worry me more than anything else. I wonder whether I will look back ten years after reclassification and realize that reclassification really just helped Google, Amazon, and other major internet players become monopolists themselves. I don’t think Title II will do that – you might say they’re doing a pretty good job crushing competitors on their own – but you never quite know, especially when you issue broad regulations of the sort Title II requires.

Nevertheless, the alternative to Title II “Common Carrier” reclassification appears to be the destruction of the free market, the tyranny of monopoly pricing, Dantean customer service, and the gradual erosion of the World Wide Web as it comes fully under the control of the handful of corporations who have absolute power, under current regulations, to manipulate and suppress competition in more and more lucrative online marketplaces. Given the dynamic role the Web has to play in the commerce and discourse of the 21st century, this outcome is simply unacceptable, despite the inevitable costs of regulation. For these reasons, I support regulation of the Internet. If you’re a conservative defender of free markets and free peoples, then you should, too.

*Yes, this is a really simplified model, which ignores plenty of other kinds of supply and demand shocks. But I’m not trying to get you a passing grade on the AP Microeconomics test; I’m trying to show you something about monopolies.

**Unless the marginal cost curve dictates otherwise, which it could. But there’s a 0% chance that the consumer is going to see the full price cut that he would in a functioning competitive free market.

*** Full Disclosure: At the time, I thought this was a good idea. In fact, I still do. It had been 70 years since telecoms had shown a tendency toward natural monopoly, and deregulation had worked very well in other common carrier industries, like air travel. It was worth trying deregulation in telecommunications as well.

UPDATE: In response to a few other blogs which linked to this piece, I wrote a small follow-up a few days later.

UPDATE II: A couple of readers have asked why the usual Disqus comment thread isn’t showing up below this post. After spending fifteen minutes looking through the Disqus control panel, I have an answer: I have absolutely no idea. Readers have spontaneously started leaving comments on this post over here; I invite you to join them.

UPDATE III – 5 Feb 2014: A friendly reader pointed out that, in the original version of this post, I conflated two lawsuits against Net Neutrality — Comcast v. FCC (2010) and Verizon v. FCC (2014) — into one (which I called Comcast v. FCC (2014)). I have corrected the error, which was in the paragraph that starts, “What happened, unfortunately…” Thanks, Conan!

open